Greece a unique location to live

Greece, a full EU Member State, scores high on all major factors taken into consideration when choosing a new country for relocating, such as quality of life, regulated environment, secure living conditions in urban and rural areas, access to efficient services, residence privileges for family members, freedom to travel, among others. Despite its small size, Greece features a particularly diverse natural environment, providing many recreational opportunities. This, combined with a spirited lifestyle blending both ancient and modern Mediterranean culture, makes Greece a sim- ply extraordinary place to be - and a wonderful place to call home.

In Greece, a new economy is in the works. Investment opportunities are abundant and attractive in a wide range of sectors. Greece's massive reform efforts open up new investment borders that reward both first-time movers and established players.

The next decade is expected to see steady growth in tourism, ICT, energy, environmental sciences, food, beverages and agriculture, logistics and life sciences. Greece's excellent human capital, advanced infrastructure, geostrategic position and economic expansion potential attract the interest of investors from all over the world. And Greece's new investment framework supports the creation of new businesses, new synergies and new partnerships.

An outward-looking economy focused on long-term growth means that investors can look forward to particularly favourable returns. As a member of the European Union and the Eurozone, Greece remains the economic hub of Southeast Europe, an ideal gateway to the Middle East, Western Europe and North Africa, and an emerging logistics hub for the whole region.

Learn more about the Greek economy, trade and foreign direct investment, access to finance, human capital and infrastructure. Find out what other investors are saying about Greece.

The Greek government has taken an active role in charting a decisive path for Investment-friendly Greece, promotes growth and welcomes new businesses. Welcome to a new economy. Welcome to a new Greece.

History & Culture

As the birthplace of Western civilization, Greece’s cultural legacy lives on in modern Greek society. While countless archaeological sites and museums offer visitors and residents a chance to experience Greek history in person, the country’s deep heritage is also felt in the spectacular con- cert halls, the summer open-air theaters, and the bustling neighborhood art galleries found throughout Athens and other cities. Greece is today, as it has been for thousands of years, an inspiring place to be.

Lifestyle

With 300+ days of sunshine per year, the climate in Greece makes living in this Mediterranean destination a year-round joy. The country’s stunning topography and existing facilities offer countless options for recreation and relaxation, such as swimming, sailing, kite surfing, rafting, biking, rock climbing, skiing, golf, spas - just to name a few. For after-hours entertainment, restaurants, bars, clubs and cultural venues all contribute to a vibrant nightlife. A modern tourism infra- structure is at your disposal for weekend getaways to some of the world’s most beautiful locales. Whatever you choose to do, healthy and joyful living is part of the Greek lifestyle.

Gastronomy

The Mediterranean diet is a global brand that needs no intro- duction. There is nowhere on earth better suited for healthy, wholesome eating than Greece, with a rich variety of ingredients and traditional products, such as seafood, olive oil, cheeses and other dairy products, tempting pastries and specialty wines that will satisfy every foodie and thrill every cook.

Education

Greece offers a wide variety of international educational options for expatriates, from pre-schools to universities - especially for students seeking studies in English, French, and German. Many high schools offer the International Baccalaureate (IB) program and have a good track record in placing students at prestigious universities, both in Greece and abroad. At the same time, many international universities offer unique educational programs in Greece for undergraduates and graduates alike.

Healthcare

Greece offers a modern healthcare infrastructure and highly skilled physicians and specialists who have been trained in the world’s finest medical facilities. Healthcare in Greece is provided by the National Health Service and by the private sector. Employees in Greece must be insured through the National Social Security System and can also choose com- plementary private coverage.

Multilingual capability

Greece ranks favorably in the EU for its number of speakers of a second language. English is the most widely spoken second language in Greece and is often the language of business used on a daily basis, especially in foreign companies. In addition, there are speakers of most European and non-European languages.

Intellectual capital

Education has long been recognized as the most valuable asset to advancement and many students achieve high academic and professional success in Greece as well as abroad in various sectors, including medicine, science, new technologies, economics and law. Greece’s “intellectual capital” will continue to be a strong national asset and investors who are seeking special skills will have a host of competitive advantages when choosing Greece as an investment location.

Investment Opportunities in Greece

Overview

Nowadays, Greece presents unique investment opportunities through business development models that promote its competitive advantages and investment potential in various sectors of production

Foreign Direct Investments

According to the most recent data of the Bank of Greece, the (net) inflows of Foreign Direct Investment to Greece for 2019 amounted to €4.137 million. 2019 is the fourth consecutive year of growth in net foreign direct investment in our country, after an annual increase of 9.0% from 2017 to 2018, 23.5% from 2016 to 2017 and 118.5% from 2015 to 2016.

Net FDI inflows into Greece in the period 2009-2019 (in millions of euros).

Source : National Bank of Greece

Countries of origin of investment funds

Investment activity in the country over the past decade comes mainly from large-market companies such as the EU, with Germany and France being the main countries of origin for investment funds. Cyprus, as well as Switzerland, are also important sources of investment capital, with the top ten positions covered by China (with Hong Kong) which has significantly strengthened its position in previous years, the Netherlands, Canada, Luxembourg, the USA and Spain.

Net inflows of FDI by country of origin of funds in the period 2009-2019 (EUR million)

Sourse : National Bank of Greece

Main features:

- Investment activity in the country comes mainly from large market companies such as the EU.

- Germany and France are the main countries of origin of investment funds in the period 2009-2019, followed by Cyprus and Switzerland.

- The top ten places on the list of countries investing in the country over the past decade also include several non-European countries, such as China (with Hong Kong), Canada and the USA, with these countries significantly increasing their investment presence in recent years.

Sectoral allocation of foreign investment

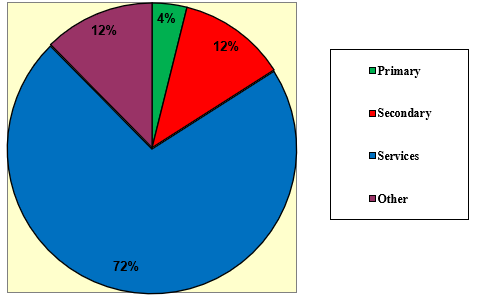

In recent years, net inflows of FDI by sector of economic activity in Greece have mainly focused on the tertiary sector, followed by a significant margin from the secondary sector. Most developed countries have a similar composition of GDI.

Net inflows of FDI by sector of economic activity in the period 2009-2019

2018, 2019: Provisional data

Source: National Bank of Greece

Main features:

- Consultation of TDI in the services. This trend was mainly dictated by the development of the country's financial system, the development of telecommunications and commercial incentives, particularly before the start of the crisis, while in recent years there has been a concentration of investment in real estate management and logistics.

- The share of the secondary sector is relatively low, compared to the country's potential, suggesting significant investment opportunities. The same applies to the primary sector, with very low DDI rates, in a country with comparative advantages for this sector (climate, etc.).

Especially:

A. Processing

Manufacturing sectors with significant investment interest in the period 2009-2019 include chemicals and petroleum products (by far), food-drinks-smoke, pharmaceuticals, machinery and computers.

Composition of net fdi inputs in processing in the period 2009-2019

2018, 2019: Provisional data

Source: Bank of Greece

Main features:

- The manufacturing sectors that attract the greatest investment interest in the period 2009-2019 are chemicals and petroleum products (by far). The pharmaceuticals and plastics sectors refer to separate categories, which have also attracted a high investment interest over the past decade. After chemicals and petroleum products, the sectors attracting the most important inputs of FDI into manufacturing are food-drink-smoke, machinery and computers and related equipment.

- The concentration of business activity in the above mentioned sectors favours both the establishment of new enterprises (Greenfield Investments) in Greece and the investment cooperation of foreign and Greek companies for the production of finished products that will meet the needs of the domestic and international market.

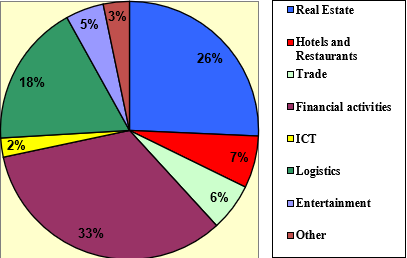

B. Services

The services sectors attracting significant investment interest in the period 2009-2019 include financial and insurance activities, property management (especially in 2018 and 2019) and logistics. It is worth noting that the category "property management" (according to the Classification of the Bank of Greece) of the following chart does not include private sales of properties that amounted to almost €2,704 million.

Composition of net FDI inputs in the services sector in the period 2009-2019

2018, 2019: Provisional data

Source: Bank of Greece

Tourism

Tourism is one of the main pillars of the Greek economy and is considered by many analysts to be an “export champion” for Greece. Ac- cording to the latest World Economic Forum 2015 Travel and Tourism

Report, Greece is ranked 31st among 141 countries in the Travel and Tourism Competitiveness Index. Greece possesses unique characteristics (climate, nature, history, culture, gastronomy, etc.) that offer a globally competitive tourism product. The gaps that exist between the de- mand and supply of tourist services provide significant opportunities in many subsectors of the Greek tourism market (luxury resorts, tourist accommodation, marinas, city breaks, golf tourism, heath tourism, etc.). Additional- ly, new laws focusing on the development of strategic in- vestments provide significant room for new investments in the sector.

Food and Beverage

The sector offers investors a plethora of attractive opportunities. It is characterized by a favorable environment with low operating costs and abundant raw materials of high quality. Meanwhile, a general

shift towards a low-calorie, healthy diet throughout the western world favors the Greek Mediterranean diet and Greece’s traditional agricultural products. Furthermore, Greek companies have already established an extensive production and sales network that offers access to emerging markets, while the F&B industry is staffed by a highly experienced and well-educated labor force.

Information and Communication Technologies (ICT)

Information and Communication Technologies (ICT)

The ICT sector offers several opportunities of investment in high-end, value-added services with a glob- al scope. The IT sector in Greece consists of a group of hard working,

highly qualified professionals with global experience and entrepreneurial talent. The strength of this sector lies in the “versatile minds” of its people. Investors can recruit top talent at a highly competitive cost. Greece is in 2nd position among the top 10 countries in Eastern Europe in ICT Development Index skills and in 16th position globally in ICT human capital. Public and EU funds are available for cooperation and development. Many Greek startups successfully compete abroad and major international players have a strong presence in the Greek market.

Energy

Energy

The evolution of the energy market in Greece provides numerous opportunities for international companies to participate in large projects in the electricity, gas, and fossil fuels sectors. In addition, there is great

potential for smaller-scale investment in Renewable Energy Sources (RES), since a national target has been set to achieve a 20% share by 2020. Greece has extremely favorable climatic conditions for wind and solar parks and there is a variety of raw materials available for biomass energy production.

Life Sciences

Greece’s life sciences industry has been developing at a vigorous rate, with new startup and spin-off companies increasingly pursuing inter- national R&D collaborations for the development of competitive, technology-based products and services. Essential to this dynamic growth is the Greek R&D infrastructure, which includes internationally recognized research institutes, teams and university groups. There are several Greek companies already competing successfully in the international pharmaceutical markets, with a strong shift towards R&D, innovation and marketing. Note that Greece has the potential for competing in the “middle market” of medical tourism, which has been among the fastest-growing sec- tors internationally over the last decade.

Export-oriented manufacturing companies

There are many Greek manufacturing companies which possess unique competitive advantages in many sub- sectors. Their patents and know-how enable them to compete globally and they have strong presence in many European and Asian countries. Due to the current economic situation, many of these companies are focusing on expanding abroad and some are looking to partner with foreign investors.

Logistics

Greece stands at the crossroads of three continents (Europe, Asia, Africa), being a strategic hub for the development of transportation in the greater region. With maritime trans- port accounting for 80% of global trade by volume and container, Greece’s geographical position as a gateway between East and West render it highly attractive for investments in transport and logistics.

RESIDENCE PERMIT – GOLDEN VISA

Overview and legal frame

With a new vision for development, Greece aims to attract foreign direct investments in infrastructure, manufacturing, energy, tourism, agriculture and other sectors through flexible and fast administrative procedures, and by promoting its natural resources, well-educated human capital and other unique comparative advantages in the broader South-East- ern European region.

Greece has set up a flexible and fast procedure for non- EU/ EEA foreign investors who wish to obtain an entry visa and a residence permit for the purpose of investment activity in Greece. Residence permits can also be granted to company executives involved in the implementation and/or the operation of the investment project. Up to 10 permits may be issued for an investment project (investors and executives), depending on the investment scale.

The investment activity may be implemented through the construction of new facilities (greenfield investments) or business acquisitions, restructuring as well as expansion of current activities (brownfield investments), provided that it has a positive impact on the national economy.

Residence permits offered to investors and executives can be renewed every five years, as long as they maintain their position in relation to the investment and the investment continues to be active. In addition, they may be accompanied by their family members - spouse, unmarried children up to the age of 21, and the first degree ascendants of the spouses - who are also beneficiaries of the right to enter and obtain a residence permit.

For more information or clarifications on this program, please contact us and our legal department will follow up your request!

According to Greek Law:

A long-term visa (national visa / D-type visa) is an authorization issued by the Greek consulates for the entry and stay on Greek territory of non-EU/EEA citizens for a period exceeding 90 days and up to 365 days, according to the respective national regulations or European Union law.

A residence permit is an authorization issued by the Minis- try of Migration Policy for the legal residence within Greek territory of non-EU/EEA citizens, in accordance with the pro- visions of European Union (Council Regulation (EC) 1030/02, as applicable). There are different categories of residence permits and different types of permits within each category. Employment rights depend on the type of permit issued.

The legal basis of the program concerned (entry and residence for investment activity) is found in Article 16 of Law 4251/2014, as amended and completed by Article 8 (par. 21) of Law 4332/2015 and Article 84 (par. 1 to 6) of Law 4399/2016.

Details concerning the program implementation, such as the minimum required investment, the procedure and the re- quired documentation, are determined by a Joint Ministerial Decision.

Beneficiaries of the residence permit for investment activity

Beneficiaries of the right to enter and obtain a permanent residence permit under this program are:

Up to 10 permits may be issued for investors and executives for an investment project, depending on the investment scale.

Duration-Renewal of the residence permit

The residence permit for investment activity (for investors or executives) is granted for a five-year period and is renewed every time for an equal duration, provided that the beneficiary maintains the status (investor or executive) in relation to the investment and that the investment continues to be active.

For the family members concerned, their residence permit expires upon the expiry of the sponsor’s residence permit. Note that the unmarried children of the applicant who are originally admitted to the country under the terms and requirements of the residence permit for investment activity are granted residence permits for family reunification until the age of 21.

Children reaching the age of 21 are entitled to an autonomous residence permit up to the age of 24 without specific preconditions. This permit is not linked to the status of the family sponsor. After the age of 24, further renewal is possible according to pertinent national immigration legislation.

δικαιολογητικά για την αγορά ακινήτου

1. Φορολογική ενημερότητα από την Δ.Ο.Υ. Εισοδήματός.

2. Πιστοποιητικό περί μη οφειλής σχετικού φόρου λόγω κληρονομιάς, γονικής παροχής ή δωρεάς. Αν ο τίτλος κτήσης του πωλητή είναι από κληρονομιά, γονική παροχή ή δωρεά που έχουν γίνει μετά την 01-01-1995 απαιτείται το παραπάνω πιστοποιητικό περί μη οφειλής σχετικού φόρου.

3. Βεβαίωση Ασφαλιστικής ενημερότητας από το Ι.Κ.Α οπου απαιτείται.

α) Σε περίπτωση που το ακίνητο έχει κτιστεί εντός της τελευταίας δεκαετίας, απαιτείται βεβαίωση του ΙΚΑ της περιοχής του ακινήτου, από την οποία προκύπτει ότι έχουν πληρωθεί οι ασφαλιστικές εισφορές.

β) Αν ο πωλητής ασκεί επάγγελμα επιτηδευματία, ελεύθερου επαγγελματία ή συμμετέχει σε Α.Ε. ή Ε.Π.Ε κ.λ.π., απαιτείται να προσκομίσει ασφαλιστική ενημερότητα από το αρμόδιο ΙΚΑ.

4. Πιστοποιητικό ενεργειακής απόδοσης , εφόσον πρόκειται για κτίσμα άνω των 50 τ.μ.

5. Πολεοδομική άδεια, εφόσον η άδεια ανέγερσης του κτίσματος έχει εκδοθεί μετά την 14-03-1983.

6. Βεβαίωση της αρμόδιας Πολεοδομίας για την περαίωση της διαδικασίας της τακτοποίησης ημιυπαιθρίου χώρου

7. . Βεβαίωση μηχανικού περί ολοκλήρωσης της διαδικασίας υπαγωγής στο άρθρο 24 του Ν. 4014/2011, όπως τροποποιήθηκε με το Ν. 4178/2013.

8. Βεβαίωση μηχανικού περί μη ύπαρξης αυθαίρετων κατασκευών

9. Απόσπασμα κτηματολογικού διαγράμματος ή πιστοποιητικό περί υποβολής δηλώσεως στο Κτηματολόγιο εφόσον το ακίνητο βρίσκεται σε περιοχή η οποία έχει ενταχθεί.

10. Τοπογραφικό διάγραμμα εξαρτημένο από το κρατικό σύστημα συντεταγμένων, όταν πρόκειται για οικόπεδο και αγροτεμάχιο.

11. Πιστοποιητικό από την αρμόδια Δ.Ο.Υ. περί μη οφειλής Φόρου Ακίνητης περιουσίας σε περίπτωση που ο πωλητής είναι Νομικό Πρόσωπο.

12. Δήλωση ιδιοκτησίας από τον αρμόδιο Δήμο (εάν το ακίνητο βρίσκεται εκτός Γενικών Πολεοδομικών Σχεδίων δεν χρειάζεται η δήλωση ιδιοκτησίας) (όπου απαιτείται )

13. Βεβαίωση περί μη οφειλής εισφοράς σε γη και χρήμα από τον Δήμο που βρίσκεται το μεταβιβαζόμενο ακίνητο ( όταν απαιτείται)

14. Βεβαίωση από Δασαρχείο (όταν απαιτείται)

15. Πιστοποιητικό ΕΝ.Φ.Ι.Α το οποίο αφορά την πιστοποίηση πληρωμής όλων των φόρων ακινήτων (ΕΕΤΗΔΕ, ΕΕΤΑ, ΦΑΠ) για τα έτη 2010 , 2011, 2012 και 2013. και είναι απαραίτητο από 01-01-2014 για όλες τις μεταβιβάσεις των ακινήτων (π.χ πώληση, δωρεά , γονική παροχή, αποδοχής κληρονομίας κλπ).

Δικαιολογητικά μεταβίβασης και μετεγγραφής του ακινητου

- Δελτίο Αστυνομικής Ταυτότητας ή Διαβατήριο

- Αποδείξεις πληρωμής του φόρου μεταβίβασης ακινήτου (Φ.Μ.Α.) από την αρμόδια Δ.Ο.Υ. προκειμένου να υπολογιστεί και να καταβληθεί ο φόρος ( Στην αγορά κατοικίας το ποσοστό του φόρου είναι 3%., ενώ για την αγορά νεόδμητων ακινήτων με άδεια κατασκευής από την 1η Ιανουαρίου 2006 και μετά ο φόρος μετατρέπεται σε ΦΠΑ 24%. (εξαιρείται η πρώτη κατοικία) . Με ΦΠΑ επίσης επιβαρύνεται ο οικοπεδούχος στην περίπτωση της αντιπαροχής.

- Φύλλα υπολογισμού της αντικειμενικής αξίας του ακινήτου που πρόκειται να μεταβιβαστεί, σε ειδική δήλωση προς την αρμόδια Δ.Ο.Υ. (συμβολαιογράφος)

Στην περίπτωση απαλλαγής φόρου για αγορά πρώτης κατοικίας ο αγοραστής θα πρέπει να προσκομίσει στην αρμόδια Δ.Ο.Υ.:

- Υπεύθυνη δήλωση στην οποία να αναφέρεται ότι δεν έχει χρησιμοποιήσει το δικαίωμα της φοροαπαλλαγής για απόκτηση πρώτης κατοικίας στο παρελθόν αλλά και ότι δεν κατέχει κατά πλήρη κυριότητα άλλο σπίτι ή διαμέρισμα.

- Πιστοποιητικό οικογενειακής κατάστασης.

- Αντίγραφο της φορολογικής δήλωσης των τελευταίων πέντε ετών

- Αντίγραφο του εντύπου Ε9 επικυρωμένο από τη Δ.Ο.Υ. του εισοδήματός του.

Με την ολοκλήρωση της υπογραφής των οριστικών συμβολαίων, ο συμβολαιογράφος καταθέτει ένα αντίγραφο στο υποθηκοφυλακείο για το πιστοποιητικό μετεγγραφής του ακινήτου.

Εξοδα Μεταβίβασης ακινητου

ΜΕΣΙΤΙΚΗ ΑΜΟΙΒΗ

Η μεσιτική αμοιβή ανέρχεται σε ποσοστό 2% επί του πραγματικού τιμήματος και επιβαρύνεται με 24% ΦΠΑ. Η πληρωμή γίνεται κατά την υπογραφή του συμβολαίου.

Αντίστοιχα η αμοιβή της μεσιτικής αμοιβής στην ενοικίαση ενός ακινήτου ανέρχεται σε ένα ενοίκιο πλέον 24% ΦΠΑ.

ΥΠΟΘΗΚΟΦΥΛΑΚΕΙΟ

Τα έξοδα του Υποθηκοφυλακείου καθορίζονται σε ποσοστό 4,5‰ της αξίας του ακινήτου όπως αυτή εμφανίζεται στο συμβόλαιο, και είναι υποχρέωση του αγοραστή. Κάθε πιστοποιητικό που εκδίδεται έχει κόστος 5 €

ΔΙΚΗΓΟΡΙΚΗ ΑΜΟΙΒΗ

Ο αγοραστής επιβαρύνεται και με την αμοιβή του δικηγόρου του για τον έλεγχο των τίτλων, που είναι 2% του τιμήματος. Οι αμοιβές των δικηγόρων μπορεί να διαφοροποιηθούν προς τα πάνω ανάλογα με την περίπτωση και τις συνολικές προσφερόμενες υπηρεσίες.

ΣΥΜΒΟΛΑΙΟΓΡΑΦΙΚΗ ΑΜΟΙΒΗ

Τα συμβολαιογραφικά έξοδα επιβαρύνουν τον αγοραστή και ανέρχονται κατά μέσο όρο σε ποσοστό 1% . (ΔΕΝ για αντίγραφα συμβολαίου, δηλώσεις φόρου μεταβίβασης κ.α. )

Μίσθωσεις Κατοικιών

1

- Ο νόμος ορίζει ως ελάχιστη διάρκεια μίσθωσης τα 3 έτη.

- Καταβάλλονται έως δύο μισθώματα ως εγγύηση.

- Η ετήσια προσαύξηση συνήθως ορίζεται στο συν 2 - 2,5% πλέον του ΔΤΚ (Δείκτης Τιμών Καταναλωτή), όπως αυτός ορίζεται από την Εθνική Στατιστική Υπηρεσία

- Είναι υποχρεωτικό να κατατεθεί ηλεκτρονικά μέσω του taxisnet το συμβόλαιο στην ΔΟΥ εντός 30 ημερών από τη υπογραφή του άλλως για όποια καθυστέρηση καταβάλλεται πρόστιμο. Μετά την ηλεκτρονική κατάθεση του μισθωτηρίου από τον ιδιοκτήτη, πρέπει να κάνει αποδοχή ο ενοικιαστής.

1

Επαγγελματικές Μισθώσεις Ακινήτων

- Όσον τις εμπορικές μισθώσεις, η διάρκεια της μίσθωσης βάσει νόμου είναι 3 ετη

- Εάν συμφωνήσουν και τα δύο μέρη, η μίσθωση μπορεί να συνταχθεί για περισσότερα από τρία έτη.

- Οι εμπορικές μισθώσεις φέρουν τέλος χαρτοσήμου 3,6%, το οποίο συνήθως επιβαρύνει τον μισθωτή.

- Η σύμβαση πρέπει να προσδιορίζει επακριβώς τη χρήση του μισθωμένων ακινήτων, το οποίο δεν μπορεί να χρησιμοποιηθεί για δραστηριότητες που δεν περιγράφονται στη σύμβαση μίσθωσης. (πχ εκμισθωση, διαθεση σε Airbnb κλπ.)

- Είναι υποχρεωτικό για τον Εκμισθωτή να καταθέσει τη σύμβαση στο taxinet εντός 30 ημερών από την υπογραφή της, η οποία πρέπει να γίνει αποδεκτή από τον μισθωτή. επιβάλλεται πρόστιμο για οποιαδήποτε καθυστέρηση.

- Συνηθες είναι να καταβάλλονται εκ των προτέρων ως εγγύηση 2 ενοικια.

- Ο ετήσιος ρυθμός αύξησης του ενοικίου ορίζεται συνήθως μεταξύ 2 και 2,5 %

Χρηματοδότηση

Η εταιρεία μας συνεργάζεται με όλες τις τράπεζες για κάθε θέμα χρηματοδότησης. Οι σταθερές μας συνεργασίες κατά περίπτωση (στεγαστικό , επαγγελματικό, επισκευαστικό), θα σας εξασφαλίσουν την καλύτερη δυνατή επιλογή εξατομικευμένα.

Για περισσότερες πληροφορίες επικοινωνήστε μαζί μας.

Συνεργατες

Μαυροθαλασσιτου Eλενη - Mavrothalassitou Eleni Emlaw Office |

Δικηγορικό γραφείο – Lawyer |

Φριξου 9, Παλαιο Φαληρο - Frixou 9 , Palaio Faliro |

+302109822210 |

Raffaello Development |

Construction-Energy-Development |

Metaxa 15, glyfada |

Akinita2004@gmail.com |

|

|

|

|

supporting documents for the purchase of property

1. Tax information from the Income Tax Office.

2. Certificate of non-debt of relevant tax due to inheritance, parental benefit or donation. If the seller's title is from inheritance, parental benefit or donation made after 01-01-1995, the above certificate of non-debt tax is required.

3. Certificate of Insurance Information from the I.K.A. where required.

(a) If the property has been built within the last decade, a certificate from the IKA of the area of the property is required, showing that the insurance contributions have been paid.

(b) If the seller is a professional, self-employed or participates in S.A. or Ltd., etc., he is required to provide insurance information from the competent IKA.

4. Energy efficiency certificate, in the case of a building of more than 50 sq.m.

5. Planning permission, provided that the building permit has been issued after 14-03-1983.

6. Certification by the competent Planning Authority for the completion of the procedure for the settlement of semi-outdoor space

7. . Engineer's certificate of completion of the procedure for inclusion in Article 24 of Law 4014/2011, as amended by Law 4014/2011. 4178/2013.

8. Engineer's certificate of non-existence of arbitrary structures

9. Extract of a cadastral diagram or a certificate for the submission of a declaration to the Land Registry if the property is located in an area which has been included.

10. Topographical diagram dependent on the state coordinate system, in the case of land and parcel.

11. Certificate from the competent Tax Office for non-debt of Property Tax in case the seller is a Legal Person.

12. Declaration of ownership by the competent Municipality (if the property is outside the General Planning Plans does not need the declaration of ownership) (where required)

13. Certification of non-debt of contribution to land and money by the Municipality where the transferred property is located (when required)

14. Certification by Forest Service (when required)

15. Certificate of EN.F.I.A concerning the certification of payment of all property taxes (ETEDE, EITA, PHAD) for the years 2010 , 2011, 2012 and 2013. and is necessary from 01-01-2014 for all transfers of real estate (e.g. sale, donation, parental benefit, acceptance of inheritance, etc.).

Documents for the transfer and transfer of immovable property

• Police ID Card or Passport

• Proof of payment of the property transfer tax (VAT) by the competent tax office in order to calculate and pay the tax (In the housing market the rate of tax is 3%., while for the purchase of newly built properties with a construction permit from 1 January 2006 onwards the tax is converted into VAT 24%. (excluding first residence) . Vat is also charged to the land-based person in the case of consideration.

• Sheets for calculating the objective value of the property to be transferred, in a special declaration to the competent tax office (notary)

In the case of a tax exemption for the purchase of a first home, the buyer must provide the competent tax office with:

• Responsible statement indicating that he has not used the right to tax exemption to acquire a first home in the past but also that he does not own another house or apartment in full ownership.

• Certificate of family status.

• Copy of the tax return of the last five years

• A copy of form E9 certified by the Tax Office of his income.

Upon completion of the signing of the final contracts, the notary submits a copy to the mortgage office for the certificate of transfer of the property.

Property Transfer Expenses

MESITIC COMMITTEE

The real estate fee amounts to 2% of the actual price and is charged 24% VAT. Payment is made when the contract is signed.

Similarly the fee of the real estate fee in the rental of a property amounts to a rent plus 24% VAT.

SUBJECT

The costs of the Mortgage are determined at a rate of 4.5・ of the value of the property as shown in the contract, and it is the obligation of the buyer. Each certificate issued costs 5 €

LEGAL COMMITTEE

The buyer is also charged with the fee of his lawyer for the control of the securities, which is 2% of the price. Lawyers' fees may vary upwards depending on the case and the overall services offered.

SYMBOLIOGRAPHIC COMMITTEE

The notarial costs are borne by the purchaser and amount to an average of 1% . (NOT for contract copies, transfer tax returns, etc.)

Residential Rentals

1

• The law sets a minimum lease term of 3 years.

• Up to two rentals are paid as a guarantee.

• The annual increase is usually set at plus 2 - 2.5% more than the TC (Consumer Price Index), as defined by the National Statistical Office

• It is mandatory to deposit the contract electronically via taxinet with the IOU within 30 days of its signature otherwise for any delay a fine is paid. After the online deposit of the lease by the landlord, the tenant must accept.

Professional Real Estate Rentals

• In the case of commercial leases, the duration of the lease by law is 3 years

• If both parties agree, the lease may be drawn up for more than three years.

• Commercial leases carry a stamp duty of 3.6%, which is usually charged to the tenant.

• The contract must specify precisely the use of the leased property, which cannot be used for activities not described in the lease agreement. (e.g. renting, airbnb availability, etc.) • It is mandatory for the Lessor to deposit the contract with the taxinet within 30 days of its signature, which must be accepted by the lessee. a fine is imposed for any delay.

• It is common to pay in advance as a guarantee 2 rentals.

• The annual growth rate of rent is usually between 2 and 2,5 %

Financing

Our company cooperates with all banks on any financing issue. Our stable partnerships on a case-by-case basis (housing, professional, repair), will ensure you the best possible choice individually.

For more information please contact us.

Associates

Mavrothalassitou Eleni -

Mavrothalassitou Eleni Emlaw Office Law Firm – Lawyer Frixou 9, Paleo Faliro -

Frixou 9 , Palaio Faliro +302109822210

Raffaello Development Construction-Energy-Development Metaxa 15, glyfada Akinita2004@gmail.com

- © 2025 ELPIDA MATTE

- Условия за споразумение

- Създадено от